operating cash flow ratio industry average

Average Operating EBIT Margin by Industry 20 Years of Data SP 500 Andrew Sather. The summation of all the three Cash Flows gives the total cash.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Financial ratios may be used by managers within a firm by current and potential.

. Liquidity ratios indicate how well a company is able to pay off its outstanding short-term debts. Compares currently available quick sources of cash with. The cash flow statement only deals with actual cash inflow and outflow unlike accrual accounting where entries are recorded when transactions take place rather than actual cash exchange.

A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken from an enterprises financial statementsOften used in accounting there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. PG HA ROT 40-50 Defensive interval Cash burn rate 365 X Quick ratio numerator Projected expenditures COGS Other operating expenses except depreciation Conservative view of firms liquidity. Operating margin is probably the most useful profitability ratio because its much less volatile than net margin but includes all operating expenses to run a business which gross margin doesnt.

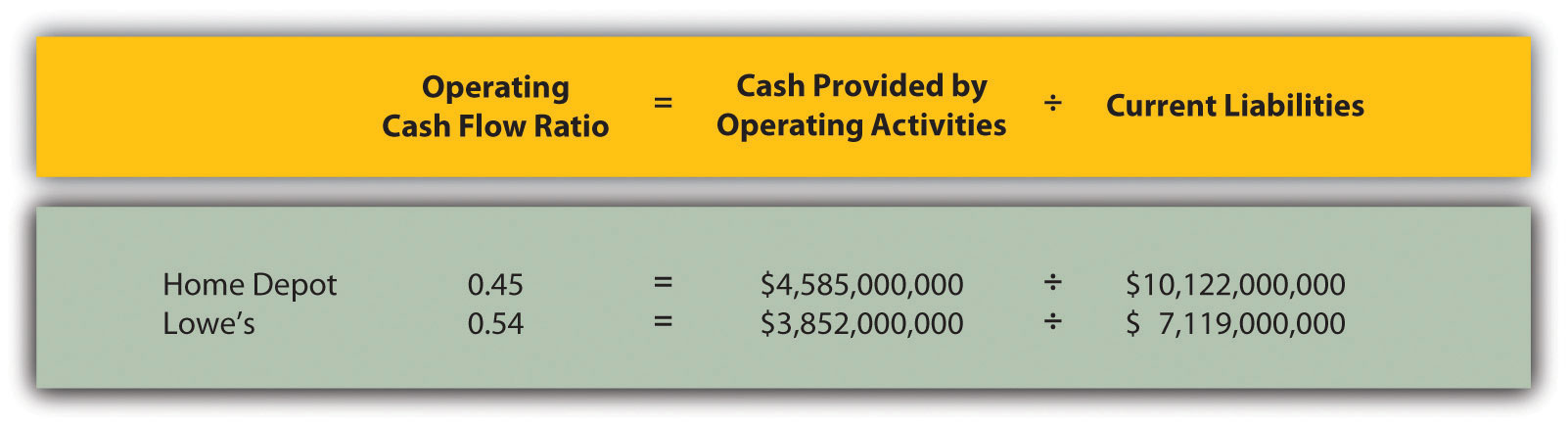

Jim AllenFreightWaves Less-than-truckload carrier Old Dominion Freight Line raised its long-term margin target Wednesday. For example your operating cash flow ratio indicates the number of times that you can pay off your current debts with cash generated from your business. Cash flow statements consist of three parts operating Cash flow Investing Cash Flow Financing Cash Flow.

CFO ratio CFO Average current liabilities Ability to repay current liabilities from operations Benchmark. Old Dominion calls for industry-leading results to continue Photo. April 3 2021.

Historical Datasets Ratios for Stocks. Liquidity Ratio Operating Cash Flow Ratio. The company now expects its operating ratio to improve to 70 30 operating margin over time potentially dipping into the 60s versus the prior target of 75.

Price To Cash Flow Formula Example Calculate P Cf Ratio

How Is The Statement Of Cash Flows Prepared And Used

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Ratio Analysis Double Entry Bookkeeping

Operating Cash Flow Ratio Definition Formula Example

Operating Cash Flow Ratio Formula Guide For Financial Analysts